To import in Brazil, as a rule, it is necessary to pay nationalization taxes, which are Import Tax, IPI, PIS and COFINS, at the federal level; and ICMS, at the state level. Depending on the importer's tax option, the taxes paid at the nationalization of the goods give right to credit, with the exception of Import Tax (II).

Aiming to help the importer in operations that may generate innovation and add in technology, the Government understood that it is possible to zero the Import Tax (II) rate for some specific goods, reducing the total tax burden of the operation. It is about this benefit that we will discuss next.

What is Ex-tariff?

Ex-tariff is a temporary reduction of federal taxes, most commonly the II, applied to specific capital goods (BK) or computer and telecommunication goods (BIT), i.e. machines, tools, parts, among others, that are used at industrial level to produce various items, mainly consumer goods; and technology products such as computers, systems, software, and telecommunication items, respectively. applied to specific capital goods (BK) or information technology and telecommunications (BIT)machines, tools, parts, among others, that are used on an industrial level to produce various items, mainly consumer goods; and technology products such as computers, systems, software, and telecommunication items, respectively.

With the Ex-Tarifário, the import tax rate goes from 16% or 14% to 0, representing a significant cost reduction.

The benefit was created with the intention of generating investments in innovation, improving the production capacity of companies, generating income and increasing competitiveness, but always safeguarding the economic balance of the domestic industry. For this reason, in addition to the above requirements, it is mandatory that there is no Brazilian production of items similar to those intended to be imported with the Ex-tariff benefit. it is mandatory that there is no Brazilian production of items similar to those intended to be imported with the benefit of Ex-tariff.

Is the Ex-tariff a tax incentive?

No. Ex-tariff is a tax benefit, not an incentive. Tax incentives, be they federal, state or municipal, are created for specific demands that stimulate the economy in exchange for some social return, such as job creation and improvement of life for the population, for example.

Tax benefits, on the other hand, are exceptionally guaranteed, that is, for a certain period and without the obligation to specifically meet social demand. The Ex-tariff is a temporary federal tax benefit for capital goods and information technology and telecommunications, granted by the Ministry of Economy and, currently, valid for a period of two years, which can be renewed at the request of the interested company.

What is the importance of the Ex-tariff regime for Brazil?

By reducing the tax burden for imported goods, the chances are increased that importing companies, usually industries, can add innovation by bringing in machinery, equipment, and parts with technology that are not manufactured in national territory.

With this innovation, the country generates income, creates new jobs, and considerably increases its competitiveness, often enabling the growth of its sales to the foreign market as well. It is possible to say that the benefit helps to make the "wheel of the economy turn". the country generates income, creates new jobs and considerably increases its competitiveness, often enabling the growth of its sales to the foreign market as well. It is possible to say that the benefit helps to make the “wheel of the economy spin”.

How to claim an Ex-tariff?

To plead for an Ex-tariff the interested company must be aware that the good, usually machine, tool or computer item, is not manufactured in Brazil. After this analysis, the company must have all the necessary technical documentation to prove the non-manufacturing, in addition to other company documents, the commercial negotiation with the manufacturer, among others that can be found here ME ORDINANCE No. 309. PORTARIA ME Nº 309.

The Ex-tariff is requested by accessing the Electronic Information System (SEI) in which an electronic request is initiated describing the import objectives, expected values, project history, and the technical characteristics of the good to be imported.SEI) In which an electronic claim is initiated describing import objectives, expected values, project history and the technical characteristics of the asset to be imported.

Because it is a procedure that requires a high degree of technical knowledge, it is advisable to hire a company with expertise in the subject to avoid filing the process, delays in the concession, or questioning by the Ministry of Economy. procedure that requires a high degree of technical knowledge, it is indicated to hire a company with expertise in the matter to avoid filing the process, delays in granting or questioning by the Ministry of Economy.

How much does an Ex-tariff request cost?

The Ministry of Economy does not charge a fee for the analysis of the Ex-tariff plea. The costs for granting the special Ex-tariff regime are those inherent in the preparation of the project and technical translations of the manufacturer's catalogs and auxiliary documents.

Companies specialized in these services usually charge from R$4,000.00 to R$50,000.00, or a proportion of the tax savings that the Ex-tariff will generate, depending on the technical complexity of the project.

What is the deadline for granting the Ex-tariff?

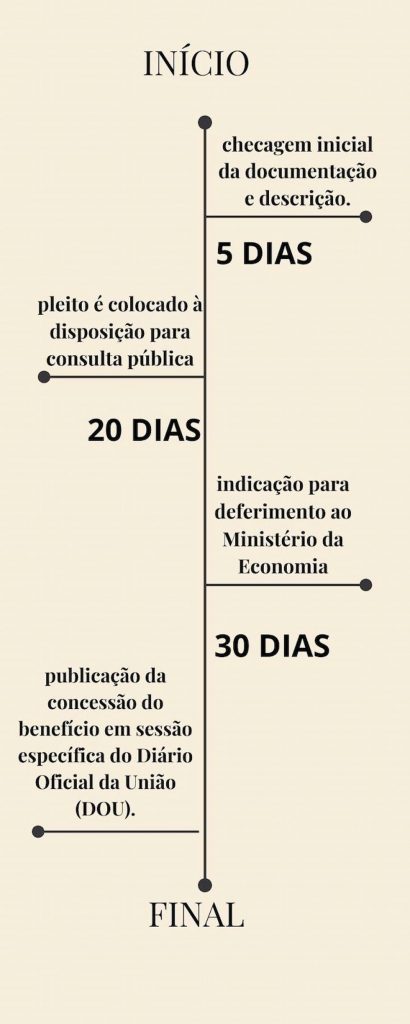

After the electronic petition is filed, the Ministry of Economy starts the analysis steps. The first is an initial check of the documentation and description suggested by the applicant, which takes an average of 5 days.

After conclusion, the plea is made available for public consultation during 20 calendar days, at which time other Brazilian companies can manifest against the granting of the benefit for that specific good if they believe they manufacture a similar national product that is equivalent to it.

After the previous step, the Ex-tariff Division (DIVEX) follows with the indication for approval by the Ministry of Economy. From the indication to the publication, it takes about 30 calendar days. The process is finalized by publication of the concession of the benefit in a specific section of the Diário Oficial da União (DOU).

Can the Ex-tariff claim be contested?

Yes, if a Brazilian company understands it is the manufacturer of a similar national good to the one that is being pleaded for the benefit, it can manifest itself contrary to the concession during the public consultation period.

If there is a manifestation, the applicant can contest, pointing out the reasons why it considers the request unfounded, and a new analysis of the complementary documentation is made, which must happen in the following 30 calendar days.

If there is no manifestation contrary to the benefit, the plea moves on to the next step immediately after the public consultation is concluded.

Considerations

The importation of machinery, parts, tools, software, telecommunication items, among others, can have their importation cost significantly reduced if there is no production of similar domestic items.

Through the Ex-tariff, the II, which is normally 16% or 14%, becomes 0.

However, the concession of the Ex-tariff special regime demands a deep technical knowledge of its procedures, which is why it is recommended to hire a company specialized in this service, enabling the concession with safety and agility. specialized company in this service, making the concession feasible with security and agility.

In the last fifteen years, Target has already conducted the Ex-tariff plea for several customers in the industry and telecommunications area, with a 100% success rate. If you would like to talk about your specific case, we will be pleased to help you. ajudá-lo.