Types of Export: Direct, Indirect and Consortium

As a way of overcoming the instabilities of the domestic market, there is the possibility of a company becoming an exporter and entering the international market. Nonetheless,

As a way of overcoming the instabilities of the domestic market, there is the possibility of a company becoming an exporter and entering the international market. Nonetheless,

A company that operates with international purchases and sales must always pay attention to the characteristics of the product, storage conditions, place of origin and

Logistics should be seen as a strategic element in an organization. Poor management and lack of monitoring of transport can bring high costs

Due to the appreciation of the dollar, export operations have increased significantly in recent months. Many companies are studying new options to take advantage of the opportunities. They are

With the appreciation of the dollar, the most common foreign currency in international transactions, export processes have been growing significantly in Brazil. for this type

Although unconventional and even somewhat unknown, this word can be of great help to companies working in international trade. did you know that there is the

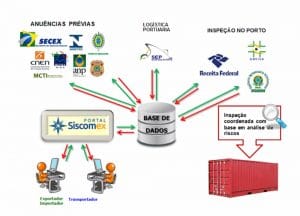

Every country needs to regulate the entry and exit of goods internationally in order to maintain control over what circulates in its territory and guarantee the safety of its users, especially with regard to products with more technical specificities. This role is usually taken on by bodies that set guidelines and monitor compliance with them.

July was a special month for the Brazilian trade balance: since 1989, this was the month with the largest surplus, totaling USD 8.1 billion in exports

Although it is still early in the 2020/2021 harvest, the data is promising: up to May, compared to the same period in the previous year,

Paranaguá Port - Paranaguá, 05/28/2019 - Photo: José Fernando Ogura/ANPr By the end of April of this year, more than 11.8 thousand tons of yarn